2024 | NEW TAX CREDIT PROGRAM:

The "Cafeteria Plan" Tax Credit Program Allows Employers to Give W-2s Free Preventative Healthcare, While Employers Get $900 Per Year for Each W-2 Employee.

*Similar to the

ERC Program, This

NEW Tax Credit Program

is Not to be Missed!!!

The "Cafeteria Plan" is paid on a pre-tax basis through a Section 125 cafeteria plan IRS Tax Code that benefits both the Employer & their W-2s. All USA Businesses with 5 or More W-2 Employees Qualify. It's that simple.

130,000+

EMPLOYEES ENROLLED

1,200+

EMPLOYERS BENEFITING

$208M+

CAFETERIA PLAN VALUE PROVIDED

More About The Program & It's Benefits:

There are currently close to 180 tax breaks, which can take the form of exemptions, deductions, credits, and preferential rates written into the U.S. Tax code. In 2023, those breaks totaled about $1.8 trillion. To put that in perspective, that’s more than the government spends on Social Security, Medicare and Medicaid, or defense.

This government program, the Cafeteria Plan, is unique because it includes benefits for the employer and their W-2 employees. This program can only be implemented by the employers.

What Are The Benefits?

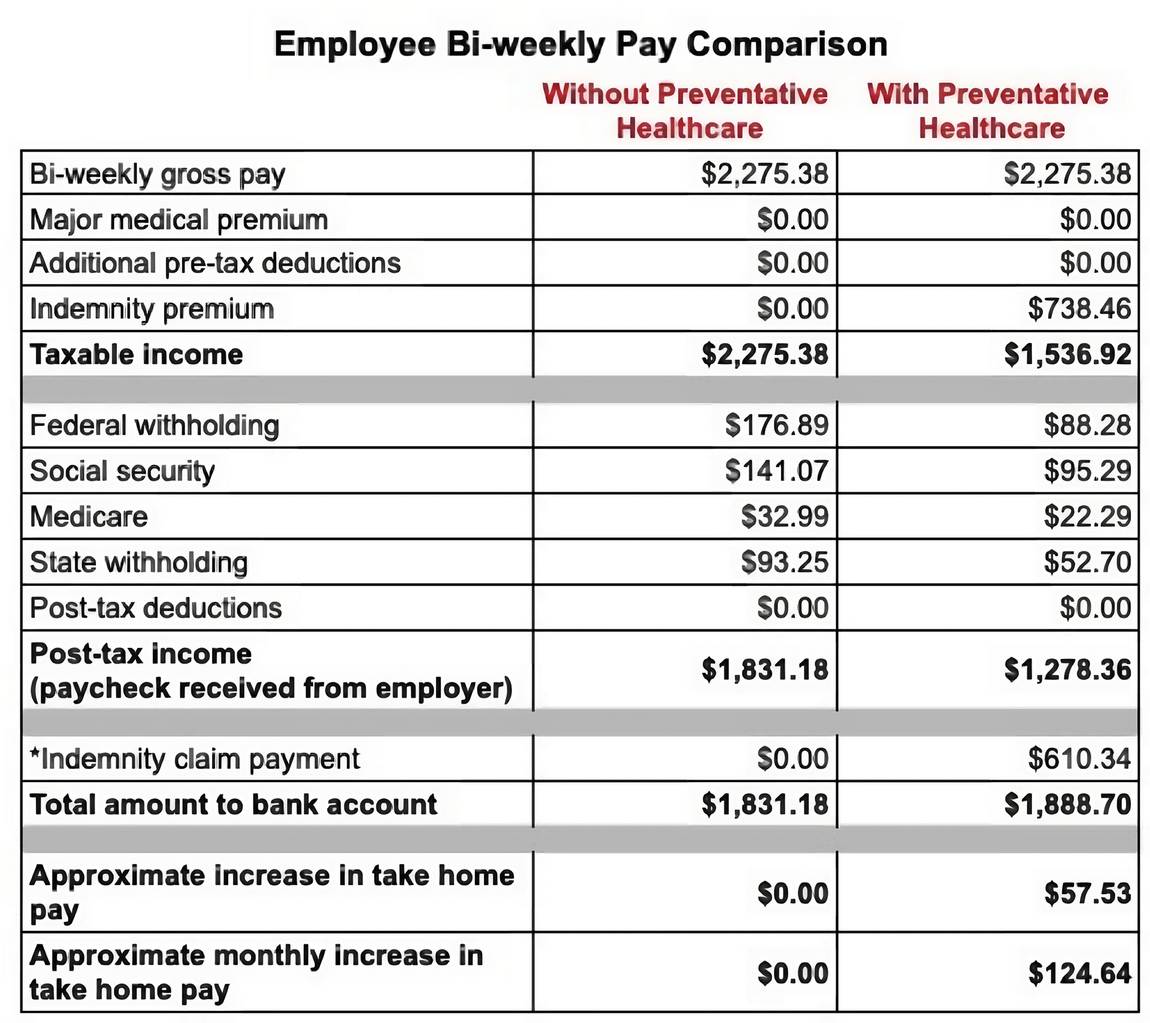

- Instantly lowering payroll taxes without making any changes to existing benefits solutions with ZERO cost to the employer.

- About $900 saved by the organization in FICA withholding per employee per year.

- About $900 saved by the employee in FICA withholding per year.

- Employees also get free preventative healthcare coverage as part of this plan.

Why Us?

- Easy to set up and even easier to maintain. We take care of all the compliance integration for you so that you don't have to jump through hoops to stay qualified for this program and continue to receive the benefits.

- Integration with payroll providers allows for almost zero monthly work time from your staff.

- Everyone benefits: W-2 employees earn money plus they and their dependents can take advantage of real time and saving benefits that are included in the plan at no additional cost.

- Benefits include: 24/7 Telemedicine visits, access to hundreds of free prescription drugs, preventative screenings, counseling services, and much more.